The employee retention credit (ERC) had been set to expire on Jan. 1, 2022, but the Infrastructure Investment and Jobs Act accelerated the end of the credit retroactive to Oct. 1, 2021, except for wages paid by a recovery startup business, for which the ERC's expiration date was unchanged. See the SHRM Online article IRS Addresses Retroactive Termination of the Employee Retention Credit.

The Families First Coronavirus Response Act (FFCRA) tax credit for COVID-19-related paid leave expired Sept. 30, 2021, following the American Rescue Plan Act's extension and expansion of the credit until then. See the SHRM Online article Should Employers Provide Pandemic-Related Leave Though FFCRA Tax Credit Has Expired?

The Paycheck Protection Program (PPP) was extended several times, until May 31, 2021. See the SHRM Online articles Congress Approves Extension of Paycheck Protection Program and Paycheck Protection Program Is Out of Cash for Most Businesses.

Pandemic Emergency Unemployment Compensation (PEUC) and Pandemic Unemployment Assistance (PUA), after a series of extensions, expired on Sept. 6, 2021. See the SHRM Online article Senate Passes $1.9 Trillion COVID-19 Economic Relief Bill.

T he Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted on March 27, is a $2.2 trillion stimulus package that provides direct financial assistance to Americans and offers eligible businesses tax credits, deferred tax payments, and loans through the Paycheck Protection Program (PPP) to encourage and enable eligible employers to keep employees on their payroll.

Here's a summary of the significant employment law provisions in the CARES Act and answers to frequently asked questions.

There are complex interconnections between the CARES Act and the Families First Coronavirus Response Act (FFCRA), but in some instances the CARES Act has provided some needed clarity.

Section 3605 clarifies that employees do not need to wait another 30 days upon rehire to be eligible for Emergency Family and Medical Leave Act (FMLA) leave if they were laid off on March 1 or later and if they worked for their employer during 30 of the last 60 days prior to layoff.

Section 3606 amends the FFCRA to allow employers and self-employed individuals to obtain a payroll tax credit advance for payment of mandated Emergency FMLA or Emergency Paid Sick Leave. Penalties for failure to make the required payroll tax deposits will be waived by the Secretary of Treasury if doing so is in anticipation of receiving the FFCRA payroll tax credit.

Sections 3601 and 3602 restate the FFCRA's paid leave caps of:

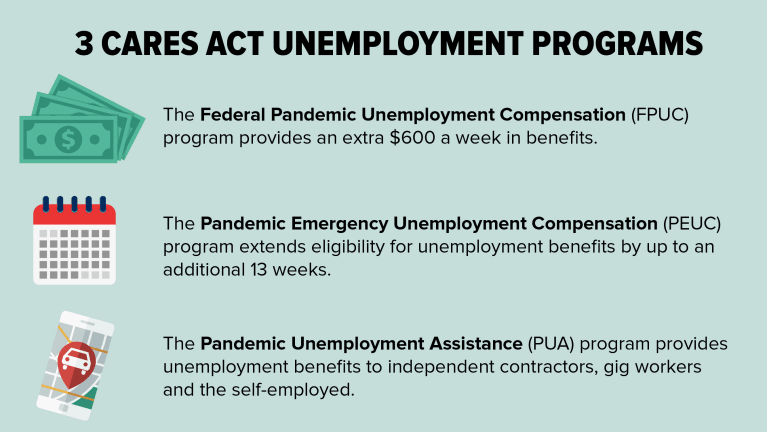

The CARES Act provides funding to eligible states to allow those states to offer expanded unemployment assistance due to COVID-19 pandemic, including the following the measures.

Pandemic Unemployment Assistance (PUA) Program (Sec. 2102)

The Pandemic Unemployment Assistance Program is a temporary program, set to expire on Dec. 31, 2020. The PUA provides workers who are unemployed or unable to work due to COVID-19 with up to 39 weeks of unemployment benefits.

Federal Pandemic Unemployment Compensation (PUC) (Sec. 2104)

Section 2104 provides individuals who qualify for unemployment or PUA benefits with an additional $600 per week for up to four months through July 31, 2020.

Pandemic Emergency Compensation Program (Emergency Compensation) (Sec. 2107)

The Pandemic Emergency Compensation Program provides federal funding for up to 13 weeks of additional unemployment benefits to individuals who are not receiving other benefits or pay and are able, available, and actively seeking work.

Funding the One-Week Waiting Period (Sec. 2105)

The federal government will fund the cost of the first week of unemployment benefit payments in states that waived the traditional one-week waiting period. Many states have already waived the one-week waiting period to qualify for the FFCRA's requirement to receive increased funding of unemployment benefits.

Paycheck Protection Program (PPP)

The CARES Act provides a paycheck protection program that expands on the Small Business Administration's 7(a) loan program for small businesses to cover certain payroll and other costs. Under the PPP, eligible employers will be provided with partially forgivable small business loans to cover certain payroll costs, employer group health costs, and other employer incurred costs for eight weeks after the loan origination date. The covered period for loans is Feb. 15 through June 30, 2020.

Emergency Economic Injury Disaster Loans

The CARES Act allows advance payments under the Small Business Administration's Emergency Economic Injury Disaster Loans to be used to cover the costs of providing paid sick leave to employees due to COVID-19.

To be eligible to receive a loan under this program, the business must certify, in good-faith, that it will comply with several requirements including not abrogating existing collective bargaining agreements for the term of the loan plus two years and to remain neutral in any union organizing effort during the term of the loan. Additional guidance will likely be forthcoming to define what it means to "abrogate existing collective bargaining agreements" and to "remain neutral".

Employee Retention Credit

Employers whose operations are fully or partially suspended during the COVID-19 pandemic or whose quarterly receipts dropped by more than 50% as compared to the same quarter in the prior year, may receive a refundable payroll tax credit for 50% of wages (up to $10,000 per employee) paid during each calendar quarter during the COVID-19 pandemic.

Funding for Short-Time Compensation Programs (Secs. 2108 to 2110)

States that have or will implement certain workshare programs for employees, are eligible to receive additional funding. Under workshare programs, employers reduce the average hours of current employees, across the board, rather than conducting layoffs or furloughs. Those employees then receive pro-rated unemployment benefits known as Short-Time Compensation (STC) benefits. Section 2108 of the CARES Act provides that the federal government will reimburse states 100% of the STC paid under a state's existing workshare program, through December 31, 2020. Section 2109 provides federal funding incentive for states without a workshare program to create one.

Q: Can an employee receive both PUA and PUC benefits?

A: Yes. PUA benefits may be claimed for full or partial weeks of unemployment or inability to work due to COVID-19, experienced by an individual between Jan. 27 and Dec. 31 (generally up to a maximum of 39 weeks). The additional $600 PUC weekly benefit is payable through July 31. Eligible individuals are entitled to receive the extra $600 even if the payment results in earnings above their pre-unemployment earnings level.

Q: PUA benefits are only available to covered individuals. Who are "covered individuals"?

A: Covered individuals are those individuals who provide a self-certification indicating that they are "able" and "available" to work, as those terms are defined by state law, but are totally or partially unemployed or are unable to work due to:

Q: Does "covered individuals" include those who are not otherwise eligible for state unemployment benefits, but meet the above criteria?

A: Yes. PUC benefits are available to self-employed workers, independent contractors, individuals seeking part-time employment, individuals without a sufficient work history, and those individuals who would not otherwise qualify for regular unemployment benefits under state or federal law.

Q: Are covered individuals who are receiving sick leave or other paid leave benefits eligible to receive PUC benefits?

A: No. PUC benefits are not available to covered individuals while they are receiving paid sick leave or other paid leave benefits or able to telework with pay.

Erik K. Eisenmann is an attorney with Husch Blackwell in Milwaukee © 2020 Husch Blackwell. All rights reserved. Reposted with permission.